Blog

The Pivotal Consumer and Retail Technology Priorities for 2021

As we continue to make progress emerging out of the COVID-19 health crisis, key trends that I have been following closely are both consumer priorities and retailers' technology focus areas. At the height of the lockdowns in 2020, consumers chased convenience and safety as primary purchasing drivers.

Forty-percent of the time in four countries (USA, UK, France, and Germany), this included switching retailers that were more responsive to their new shopping patterns. This was especially prevalent in the United States where 46% of the consumers made the switch. Subsequent research indicated that 88% plan to stick with their new shopping brand choices.

On the technology front, digital acceleration was the operative challenge that all retailers faced. "By some estimates, we (retail) have vaulted ten years ahead in consumer and business digital penetration in less than three months."

This article highlights technology focus areas that consumers are prioritizing as we enter a disrupted new normal. It also summarizes new research on the top retailer technology priorities to meet the demands of a digitally empowered consumer.

Surprising Consumer Shopping Technology Preferences

"Consumers are craving convenience of the pre-pandemic world, longing for the ease taken for granted before daily habits were upended. Businesses are under pressure to rapidly adapt their operations to develop a resilient customer experience while maintaining convenience. Companies must preserve the swift and seamless shopping journey across all channels."

The surprising top 5 consumer in-store preferred shopping features identified in Euromonitor research published in January 2021:

- Select items and be able to immediately walk out of store with purchase executed.

- Scan items while shopping and make payment via mobile phone.

- Earn loyalty points automatically when entering with the assistance of facial recognition.

- View additional information via interactive shelf displays.

- Virtual fitting rooms which show you how the product will fit.

- Above features and the rest identified in the research scream contactless, more convenience, and greater time savings.

Top Retailer Priorities for 2021

The latest RIS News Store Experience Study projects retail sales to 4.7% in 2021. "Fueling this increase are massive increases in m-commerce (12.2%) and desktop e-commerce sales (9.7%) — the foundation for both was laid during the pandemic. Changing customer behavior, specifically lower in-store traffic coupled with an increased preference for digital journeys, caused retailers to pivot towards BOPIS, curbside and ship from store."

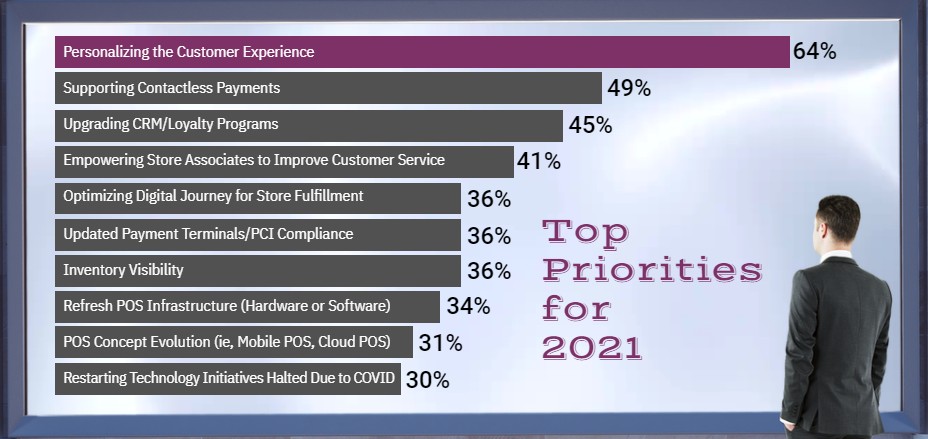

Below are the top retailer priorities for 2021.

Personalizing the customer experience has been number 1 for the last four years. Contactless payments as the report indicates is a nod to COVID-19 and CRM / loyalty programs have been mainstay in the top 5 year-after-year.

IT spending continues to increase in response to these priorities. For Tier 1 retailers, enterprise IT budgets will be up 5% and store technology spend up 4% in 2021.

The Technology Investments of Tomorrow

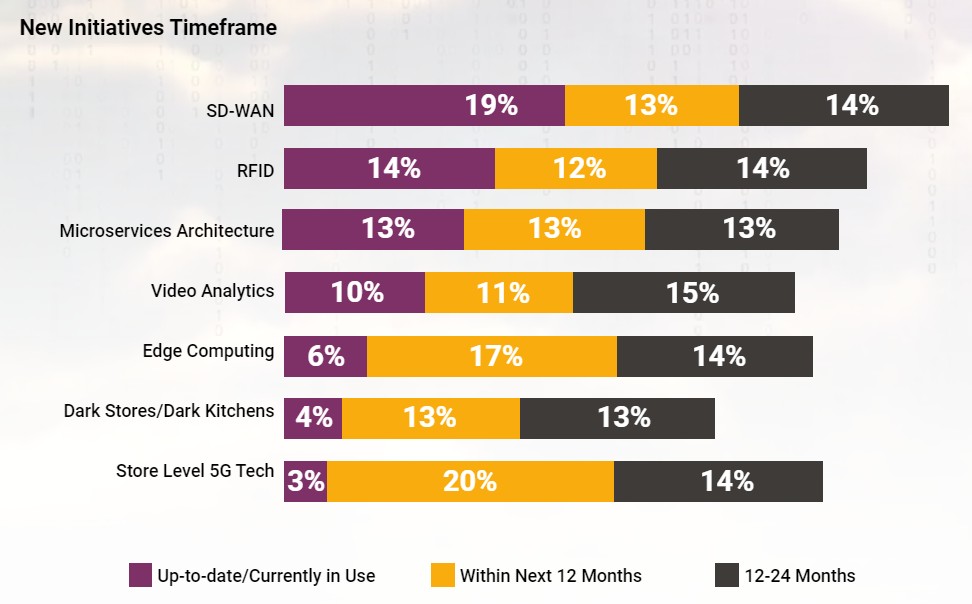

Of great interest every year are the emerging technology investments. The list for 2021 includes:

Expansion of more devices on the network, requires focus on number one. 5G will accelerate connectivity as retailers expect its usage to grow 11x in the next 2 years.

RFID has come a long way, just from a few years ago. It's a sign on the accelerated importance of inventory visibility whose value has also been accelerated the by pandemic. "Surprisingly, 48% of those that have RFID deployed are FDCM (Food / Drug / Convenience / Mass Merchandisers) retailers, and 32% were GMS (General Merchandise) retailers — those numbers were expected to be reversed. Those that have deployed RFID place a higher priority on inventory visibility (31% higher), optimizing the digital journey for store fulfillment (11% higher), and personalizing the customer experience (5% higher)."

Why Retail Leaders Keep Winning

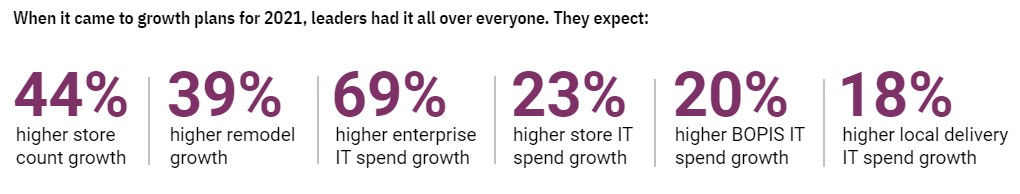

This year's RIS Study included very interesting insights on the priorities of retailers that lead the industry. For this research, a leader is defined as any retailer that claimed a sales increase of 10% or more from 2019.

"Given recent events surrounding the COVID pandemic, it should come as no surprise that 75% of the leaders reside in the FDCM segments, and half of those are in the food/grocery category. Revenue expectations for these retailers for 2020 are 779% higher than overall, though the difference drops to less than 3% for 2021. In other words, both leaders and average retailers are expecting things to return to “normal” for 2021."

"For in-store technology deployments in 2021, leaders were 28% more likely to be deploying mobile devices for managers, 93% more likely for traditional self-checkout, 60% more likely for consumer mobile checkout apps, and 171% more likely for electronic shelf labels."

2021 will be much improved from 2020, especially as vaccine deployments ramp up. Strategic initiatives deployed in the first half of 2021 will lead to more aggressive growth in the second half. Remember, it's greater focus on consumer convenience, safety, and immersive experiences across harmonized retail channels.

This article was originally published at tonydonofrio.com

* * *

Tony D'Onofrio is CEO of Prosegur's Global Retail Business Unit and CEO of the advisory group TD Insights. Globally he is recognized as a social media influencer in retail, security, and emerging technologies. He is listed as a top 100 Global Retail Influencer 2021 and publishes regularly on multiple global platforms including LP Magazine. His career has included executive roles in both security and information technologies companies. He is a graduate of Case Western Reserve University (BA) and Cleveland State University (MBA). His industry thought leadership activities are summarized at tonydonofrio.com.

Tony D'Onofrio is CEO of Prosegur's Global Retail Business Unit and CEO of the advisory group TD Insights. Globally he is recognized as a social media influencer in retail, security, and emerging technologies. He is listed as a top 100 Global Retail Influencer 2021 and publishes regularly on multiple global platforms including LP Magazine. His career has included executive roles in both security and information technologies companies. He is a graduate of Case Western Reserve University (BA) and Cleveland State University (MBA). His industry thought leadership activities are summarized at tonydonofrio.com.